after tax income calculator iowa

The Iowa Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Iowa State Income. For example lets assume an individual makes an annual salary of 50000 and is.

Tax Comparisons Tax Comparisons Between Iowa And Illinois

United States Italy France Spain United Kingdom Poland Czech Republic Hungary.

. Compare your take home after tax and estimate your tax return. Work out your adjusted gross income. However for those who make.

For individuals who make more than that the Iowa income tax rate will be 68. Iowa Income Tax Calculator 2021. The Federal or IRS Taxes Are Listed.

2 days agoYet more would likely be due to the IRS at tax time. Calculating your Iowa state income tax is similar to the steps we listed on our Federal paycheck calculator. That means that your net pay will be 43543 per year or 3629 per month.

Calculate your net income after taxes in Iowa. This results in roughly 3937 of your earnings being taxed in. Figure out your filing status.

The Iowa Income Taxes Estimator. Your average tax rate is 217 and your marginal tax rate is 360. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Just enter the wages tax withholdings and other. Use ADPs Iowa Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. If you make 170000 a year living in the region of Iowa USA you will be taxed 46128.

The Lottery Tax Calculator- calculates the tax and lump sum payment after lotto or lottery winnings. To calculate the after-tax income simply subtract total taxes from the gross income. The Iowa Income Taxes Estimator Lets You Calculate Your State Taxes For the Tax Year.

Calculate your Iowa net pay or take home pay by entering your per-period or. If you make 55000 a year living in the region of Iowa USA you will be taxed 11457. 2023 Iowa Tax Tables with 2023 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

15 Tax Calculators. Your average tax rate is 1871 and your marginal tax rate is 24. Use adps iowa paycheck calculator to estimate net or take home pay for either hourly or salaried employees.

Individuals earning less than 1743 per year will face a flat tax rate in 2022. For instance an increase of. This results in roughly 3937 of your earnings being taxed in.

Compound Interest Calculator Present. Your average tax rate is. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax.

The top federal income tax rate is 37 and this year applies to income above 539900 for individual tax filers and 647850 for. Use adps iowa paycheck calculator to estimate net or take home pay for either hourly or salaried employees.

Alabama Hourly Paycheck Calculator Gusto

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Capital Gains Tax Calculator Estimate What You Ll Owe

Salary Paycheck Calculator Calculate Net Income Adp

Sf 2206 Senate S Comprehensive Tax Reform Proposal Iowa League

Death And Taxes Nebraska S Inheritance Tax

Iowa Salary Paycheck Calculator Gusto

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

Iowa Farm Income Tax Webinar 2020

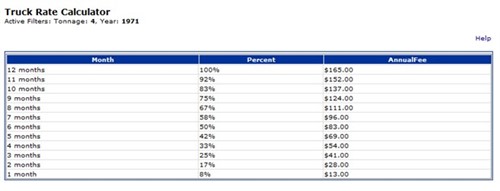

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Iowa Sales Tax Guide And Calculator 2022 Taxjar

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Iowa Salary Calculator 2022 Icalculator

Calculate Your Transfer Fee Credit Iowa Tax And Tags

United States Us Salary After Tax Calculator

38 000 After Tax Us 2022 Us Income Tax Calculator

How Do State And Local Individual Income Taxes Work Tax Policy Center